Top Equity Markets Mostly Down As Fed Rate-cut Rally Fades

Major stock markets mostly fell Monday following last week's rally, with Federal Reserve officials looking to temper expectations the US central bank will cut interest rates several times next year.

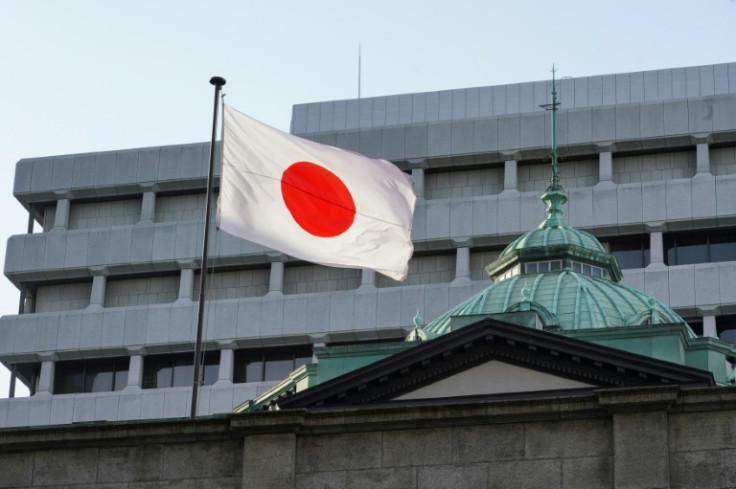

Investors are also keeping tabs on the Bank of Japan's meeting this week, though speculation it will shift away from a policy of not hiking rates has faded.

Equity indices are still set to end the year on a high after the Fed suggested it will begin loosening monetary policy as US data shows inflation coming down and the economy on course for a soft landing.

The Dow and Nasdaq last week hit record highs on Wall Street as tech firms surged, but the buying frenzy slowed Friday as investors took a step back, which analysts said was to be expected after the advances.

The Paris CAC 40 index also hit an all-time peak last week.

"We're into the final furlong and unless there's a big surprise then we're looking at some very healthy gains for the most part in 2023," noted Neil Wilson, chief market analyst at Finalto trading group.

Asia struggled at the start of this week, with Hong Kong down one percent, while Tokyo, Shanghai, Sydney, Singapore, Mumbai, Taipei, Manila and Jakarta were also in the red.

In Europe, London rose ahead of UK inflation data Wednesday, while Paris and Frankfurt retreated.

The London FTSE 100 won support from Vodafone. The mobile phone giant's share price was up nearly seven percent in late morning deals after it revealed a proposal with French peer Iliad to merge their Italian operations.

A number of Fed officials lined up last week to douse expectations they will slash rates next year. Some observers have predicted as many as six cuts, but the bank's "dot plot" forecast saw three.

The Bank of Japan's own decision is due Tuesday, and while there has been talk that it is about to shift away from years of ultra-loose policy, analysts do not expect it to do so for a few months.

Officials have kept rates in negative territory and stuck to a policy of controlling bond prices in a bid to boost the economy, but with inflation rising and the yen struggling, they are now said to be shifting.

"The BoJ has little need to rush into making policy changes," said economists at Societe Generale.

"But markets will be watching for any sign."

London - FTSE 100: UP 0.4 percent at 7,606.02 points

Paris - CAC 40: DOWN 0.4 percent at 7,566.73

Frankfurt - DAX: DOWN 0.3 percent at 16,704.39

EURO STOXX 50: DOWN 0.4 percent at 4,532.35

Tokyo - Nikkei 225: DOWN 0.6 percent at 32,758.98 (close)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 16,629.23 (close)

Shanghai - Composite: DOWN 0.4 percent at 2,930.80 (close)

New York - Dow: UP 0.2 percent at 37,305.16 (close)

Dollar/yen: UP at 142.78 yen from 142.22 yen on Friday

Euro/dollar: UP at $1.0911 from $1.0897

Pound/dollar: DOWN at $1.2662 from $1.2677

West Texas Intermediate: DOWN 0.7 percent at $70.96 per barrel

Brent North Sea crude: DOWN 0.6 percent at $76.12 per barrel

© Copyright AFP 2025. All rights reserved.