Energy Starved Europe Charms Africa

Suddenly, resource-rich African nations are the toast of the town in European capitals. European leaders with their new-found love for oil and gas are trooping to the continent to scale up imports by overcoming infrastructure hurdles and security challenges that have long stymied energy and oil production.

With the United States, Canada, Japan, Australia, and Britain in tow, the European Union (EU) has been doing all it can to limit Russia's ability to finance its special military operation in Ukraine from the proceeds from selling oil and gas to the EU.

Already, the price cap, to be enforced by the G7 nations, on Russian seaborne oil came into force on Dec. 5. The most industrialized nations are also mulling a cap on Russian crude oil and are burning the midnight oil to make it feasible by the beginning of February next year.

The price of Brent crude oil was $87.25 a barrel on Dec. 5 and G7 price cap is set at $60 per barrel. Russia, the world's second-largest oil exporter that used to supply more than 40 percent of the energy needs of the 27-member trade block, has said it will not sell oil based on the price cap even if it downs shutters of a few refineries.

The EU is bracing for a complete Russian cutoff though it has managed to fill gas reserves to 90 percent.

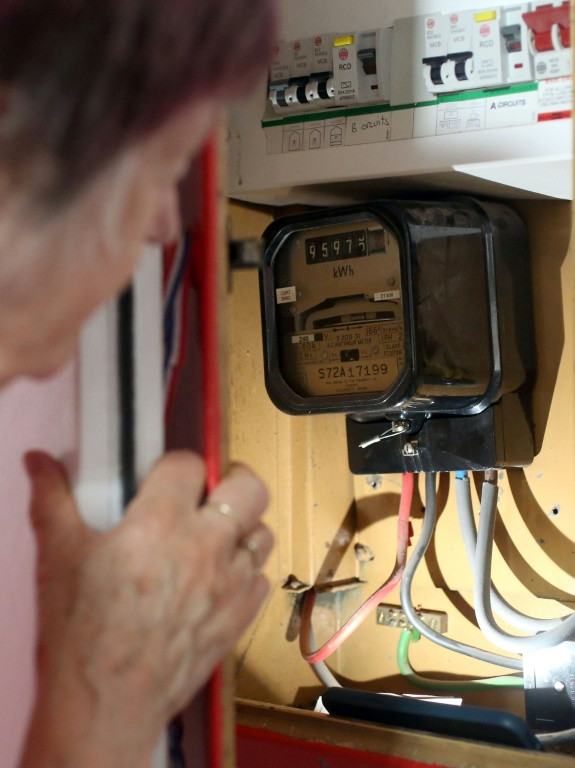

Higher oil prices have pushed up the cost of living in the EU and in the UK, where it is rising at its fastest pace in 41 years.

Europe has been scouting for alternative sources as Moscow has reduced natural gas flows, triggering soaring energy prices and fears of a recession.

Wasting no time, European leaders are making a beeline to African nations. Nigeria has Africa's largest natural gas reserves, but it only accounts for only 14 percent of EU imports. Production in the West African nation is plagued by the risk of energy thefts and high costs.

In Mozambique, large gas reserves have been discovered but Islamic militants exert influence in the nation.

Senegal's and Mauritania's coastlines contain about 15 trillion cubic feet of gas, five times more than Germany, the EU's largest economy, used in all of 2019.

European nations are wooing their African counterparts with the green energy transition, security of supply and reliable value chains.

German Economy Minister Robert Habeck kick-started a five-day trip to Namibia and South Africa on Dec. 4. Habeck is, of course, looking for new energy resources to compensate for the cut-off from Russia.

The Namibian capital Windhoek was Habeck's first stopover to ink a pact on green hydrogen production.

"Namibia has very great advantages in terms of location compared to Europe," Habeck, accompanied by a delegation of 24 German business leaders, said.

Germany will buy up to 300,000 tons per year of green ammonia, a hydrogen derivative, churned out at Namibia's Skeleton Coast on the Atlantic Ocean.

Habeck's next destination is Johannesburg, where he will attend a business summit and meet with South African President Cyril Ramaphosa, who recently visited the UK, which is funding a massive energy transition program in the second largest economy in Africa.

Habeck's Africa visit is part of a wider German mission to piece together new energy alliances after Russia cut off its gas supplies in September.

As far as Europe is concerned, African nations offer more diversified supply chains.

Already more than 400 German firms from the auto, medical technology and energy sectors operate in South Africa, which has currently cornered nearly 40 percent of German foreign trade with Africa.

Under the stewardship of the UK, western nations have started the Just Energy Transition Investment Partnership which will help South Africa to be less dependent on coal.

UK-based Hive Energy is building South Africa's largest solar firm to feed renewable energy to its green ammonia plant near a deep-water harbor in Nelson Mandela Bay.

The $4.6 billion plant will produce 780,000 tons of green ammonia per year to be shipped to Europe and the US by 2026.

Both South Africa and the UK have unveiled hydrogen strategies to establish a thriving low-carbon hydrogen sector, said the South African Ministry in a statement.

Italy, another leading EU economy, is also betting big on African energy as it plans to cut reliance on Russian gas, which currently constitutes about 40 percent of its gas imports.

State-funded Eni, the biggest foreign energy producer in Africa, is developing two gas plants in Congo Republic to produce 5 bcm of LNG.

Efforts to limit funds to Russia will put Europe on an investment spree in African nations. Of course, Europe can chip in with the technology and infrastructure that African nations lack currently to extract its vast energy sources. But when it comes to corruption and social unrest, the ball is in Africa's court.

© Copyright 2025 IBTimes IT. All rights reserved.