Column-G7 'Recognizing' FX Disruption Is Damp Squib :Mike Dolan

Japan's solo battle against an overvalued U.S. dollar may feel a little lonelier after it met G7 finance chiefs in Washington this week - and possible yearend market ructions may see its allies regret that.

After heavy lobbying from Tokyo and some considerable market speculation about sterner language to calm unruly exchange rates, economic powers gathering at the annual International Monetary Fund meeting ended up giving one of the brightest green lights possible for further disruptive dollar gains.

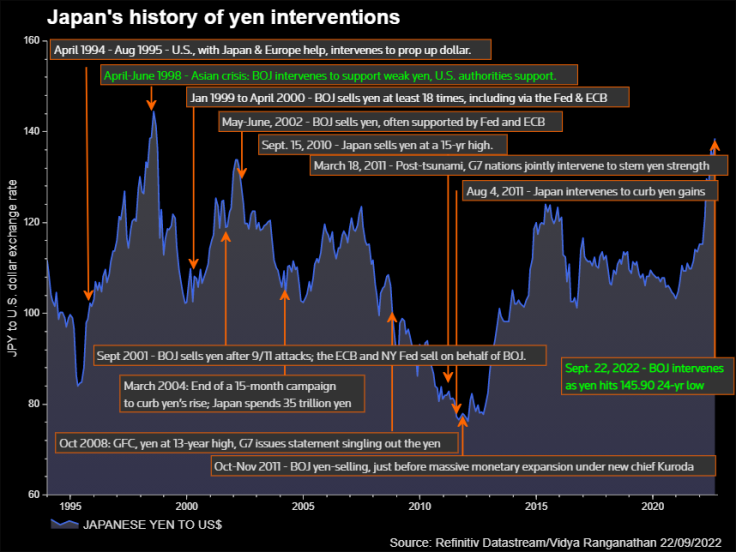

That is even as the dollar's 20% surge against the major currencies over the past year unnerves wider financial markets and government finances. An eye-watering 30% surge in just 12 months to 32-year highs against the yen this week has already drawn $20 billion in unilateral dollar sales by the Bank of Japan, while the swinging 27% jump to record highs against an ailing sterling at one point last month further unsettled restive UK asset markets.

With geopolitical tensions rendering the wider G20 finance grouping barely functional, finance ministers and central bank chiefs from G7 allies met separately - and with myriad pressing issues from the energy crunch, war in Europe and climate change.

Their joint communique released by the U.S. Treasury late on Wednesday did give Japan something - but it was thin gruel.

"Recognizing that many currencies have moved significantly this year with increased volatility, we reaffirm our exchange rate commitments as elaborated in May 2017," the G7 wrote.

And, for the record, the 2017 phraseology was that excess volatility and disorderly currency moves have negative impacts on their economies and financial stability.

Maybe that is all they wanted or needed to say, short of action. But the choreography lacked punch, to say the least - the slightly jaded reference back to a five-year old formulation giving the impression of afterthought, or an issue most did not want to take head on right now.

It was especially lukewarm given how Japan's Finance Minister Shunichi Suzuki claimed he conveyed the problem to his counterparts - how he was "deeply worried" about sharply rising volatility".

"We cannot tolerate excessive volatility in the currency market driven by speculative moves," he opined after. "We're watching currency moves with a strong sense of urgency."

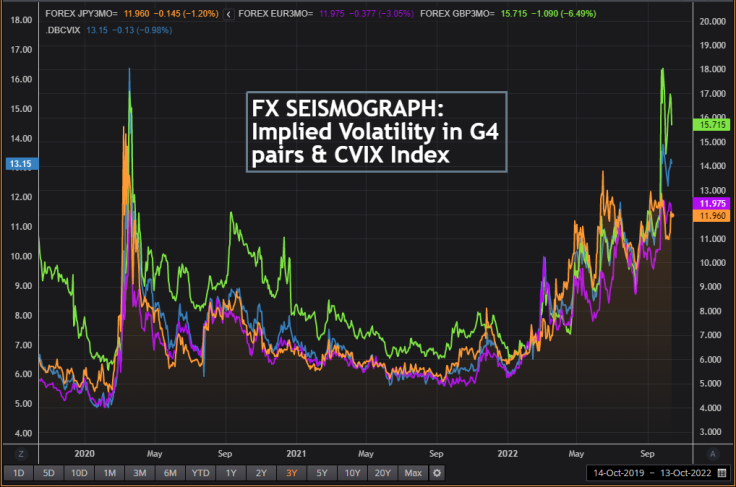

Judging by a seismograph that is contained in three-month currency options, the implied volatility of G4 currency pairs has more than doubled over the past year to the peaks of the pandemic shock.

But the final G7 statement seemed to accept it as a fact of life, reflecting the more aloof take on events from IMF chief economist Pierre-Olivier Gourinchas earlier in the week.

Gourinchas acknowledged dollar strength was putting a lot of strain on countries but insisted it was fundamentally justified, not dysfunctional and countries should just stand back and let currencies adjust.

That will sit uncomfortably with Japan as it watched the dollar soar again on Thursday to 32-year highs above 147 yen after hot U.S. inflation readings for September ratcheted up forecasts of just how high Fed rates have to go as the BOJ stands pat.

Graphic: Dollar zooms-

Graphic: FX volatility surge-

FEEDING FRENZY

Even though currency valuation metrics and fair value models vary and often give wildly different signals, most frequently cited measures assume the dollar is between 10-20% overvalued.

Despite that, many investors feel there is more to come and will push it higher - with differing and often circular arguments.

Raw interest rate gaps have been the big driver. But as Fed rates climb and global stock and bond prices plummet the attraction of dollar cash as a haven is enhanced even though resulting dollar currency strength often exaggerates that stress in a vicious cycle.

Similarly, geopolitical worries and the related energy shock have ballooned balance of payments gaps outside the United States as import bills surge - that weakens the currencies of big energy importers. But as energy is priced in dollars, resulting dollar strength just exacerbates trade gaps and inflation problems and hurts asset prices even more - further feeding stress-related dollar demand.

UBS Global Wealth Management's Chief Investment Officer Mark Haefele on Thursday said both the rate gap and global stress story will stoke further dollar gains. "We maintain our most preferred stance on the U.S. dollar and Swiss franc."

Aviva Investors strategist Michael Grady said "we continue to prefer to be overweight the U.S. dollar due to greater economic resilience and higher underlying inflation in the US."

But if an increasingly volatile and overvalued dollar is starting to feed off itself and complicating both inflation and government and household financing - during what many still hope will be a temporary political and energy shock - then Japan should perhaps have received a more sympathetic hearing.

And if spiraling yen weakness stokes Japanese inflation and forces the BoJ to lift its long standing bond yield cap - thereby joining other central banks in synchronised tightening - global markets would receive another jolt at least on par with the quake in British bond markets this month.

There is an argument that no one wants to get in the way of Fed tightening until U.S. inflation is finally licked and feel intervention threats will be useless until markets are more confident of where exactly the Fed "terminal rate" tops out.

But as an IMF working paper this summer concluded, after studies of 26 countries over almost 30 years: "Evidence supports the hypothesis that central banks can lean effectively against short-run cyclical misalignments of the real exchange rate."

The big question is whether this dollar surge is in fact a "short run" aberration or whether it is a more permanent feature of the global landscape.

Graphic: Japan's history of yen interventions-

Graphic: Japan's falling dollar reserves-

The opinions expressed here are those of the author, a columnist for Reuters.

(by Mike Dolan, Twitter: @reutersMikeD; Added chart from Andy Bruce; Editing by Marguerita Choy)

© Copyright Thomson Reuters 2025. All rights reserved.