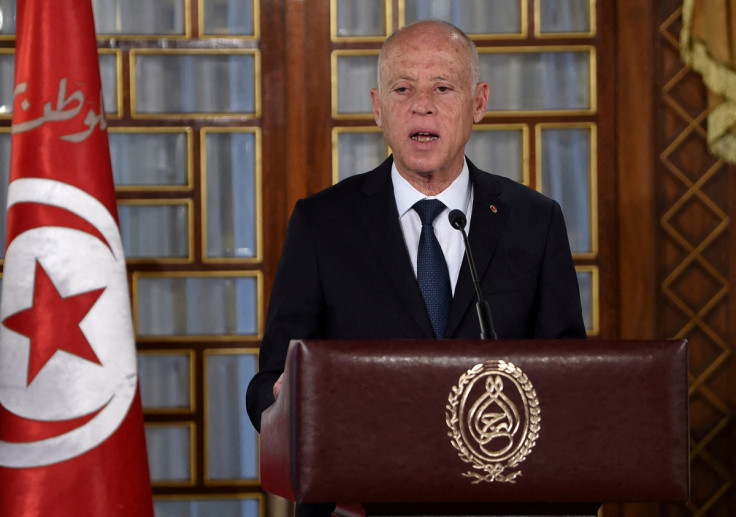

Analysis-Fate Of Tunisia's Stalled IMF Loan Lies In Hands Of Unwilling President

Tunisia's bailout talks with the International Monetary Fund have looked stalled for months, and there is little sign President Kais Saied is willing to agree to the steps needed to reach a deal and help the country avoid a financial crisis.

Tunisia reached a staff-level agreement with the fund in September for a $1.9 billion loan, but it has missed key commitments and donors believe the state's finances are increasingly diverging from the figures upon which the deal was calculated.

Without a loan, Tunisia faces a full-blown balance of payments crisis. Most debt is internal but there are foreign loan repayments due later this year, and credit ratings agencies have said Tunisia may default.

IMF chief Kristalina Georgieva said last month that Tunisia had made good progress and the board would look at the deal "quite soon". An IMF spokeswoman said a board date would be set once authorities "complete the programme requisites".

A Tunisian official said "things may not be moving quickly but they are moving steadily," adding the government expected progress "probably in a matter of a few weeks".

Donors remain sceptical.

Tunisia has fallen behind on scheduled fuel subsidy reductions, it has not issued a promised public companies law, and the powerful labour union opposes key reforms the IMF wants.

Most importantly, Saied has neither publicly embraced a deal nor committed to signing one if it is approved, leaving donors worried he may reject the loan, reverse reforms after the money arrives or blame them for any resulting economic pain.

If Tunisia takes too long to finalise the agreement, the fund may decide that the figures upon which it is based are no longer realistic and negotiations would have to start again. It is not clear when that point will arrive.

The government is already struggling to pay for imports of key goods and there have been repeated shortages of subsidised sugar, coffee, cooking oil, dairy products and medicines in recent months. Inflation is over 10%.

Without outside help, shortages could get much worse and extend to other goods such as fuel, while the government could also struggle to pay state salaries.

Few foreign donors appear willing to lend Tunisia money without the reassurance of an IMF deal, and the domestic financial market could soon be tapped out.

Alternative sources of financing - running down foreign currency reserves or printing money - would undermine the Tunisian dinar, thereby aggravating the government's difficulties with imports, and accelerating inflation.

The Central Bank has already warned against such moves.

While some foreign aid continues, with targeted loans by international financial institutions to support food and fuel purchases, it is not enough to finance Tunisia's budget.

ABRASIVE STYLE

Under the September agreement, Tunisia was meant to raise fuel prices by 3%-5% a month, donors said. It has not done so since November and though another rise is expected soon, it will need to be much higher to keep up with commitments.

Although the government said last month it had approved a law on state-owned companies seen as a precursor to restructuring efforts to reduce the massive financial burden they lay on the state, the law has not been formally issued.

The delay appears to lie chiefly with President Saied, who seized most powers in 2021, shutting down parliament, appointing a new government and moving to rule by decree.

He has shown little interest in economic policy except to blame Tunisia's problems on corruption and has spurned donor pleas to secure broad social acceptance for painful reforms through deals with a labour union that now bitterly opposes him.

Far from conciliating donors, his abrasive style, his clampdown on opponents and rhetoric against immigrants and foreign interference has given them little reason to grant Tunisia extra leeway.

The World Bank has already put future work with Tunisia on hold, and the IMF on Thursday said it was "concerned" about recent developments.

Saied's broader remarks on aid meanwhile suggest that if the IMF and donors are hoping for his public endorsement of a deal that would require unpopular spending cuts, they may be out of luck.

"The solution is not to submit to diktats... which are a new form of colonialism," he told Prime Minister Najla Bouden last month.

If foreign countries want to help Tunisia, they should "return our looted money and drop the accumulated debts" he added.

© Copyright Thomson Reuters 2025. All rights reserved.